Competitor Intelligence (CI)

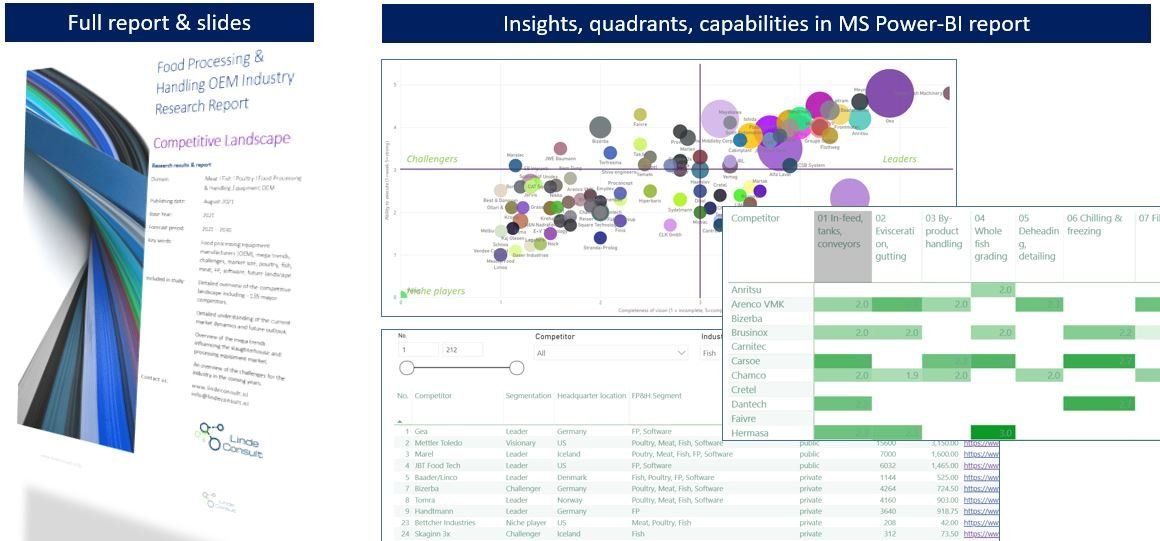

Competitive Intelligence (CI) is the practice of monitoring, gathering, and analysing data on your competitors and industry to make better business decisions. It can help brands identify gaps in their strategies and discover growth opportunities. This article presents the new Linde Consult Competitive Intelligence Dashboard, dedicated to the FP&H industry, and explains why you should start using it right away.

What is this Dashboard with Competitive Intelligence for the Food Industry?

The Linde Consult FP&H Database has been in development for 2 years now and includes detailed data on the 250+ most prominent OEMs active in segments Poultry, Meat, Seafood, Bakery, Vegetables/fruits/nuts, Beverage and Dairy. The level of detail is unmatched!

Users with access can filter through a treasure of relevant competitor data on e.g. industry segment, company size, revenues, strength of vision, and ability to execute. As well, they can drill down on the product portfolio as marketed by the OEMs and analyse data per processing (sub)step, category, species, to answer specific questions like:

- Which OEMs offer the best Poultry cut-up & deboning solution? What are potential fits/gaps between product offerings of supplier A, B and C?

- Which equipment manufactured by a Poultry OEM could also be adjusted cross-segment to fit Meat or Plant based requirements?

- Which OEMs are strong in onboard equipment for shrimp grading? How does equipment compare on throughput, no. of operators needed, or price? What are strategic groups, and why are they clustered?

- Which OEMs offer the best End-of-line solutions for the Baking industry, packing & labelling or stuffing & filling? Are they also present in Poultry, Meat and Beverage segments?

The dataset is growing fast, but at the time this is written is contains 10K+ machines and solutions described and scored on technology level, design sophistication and build quality. You can even view estimated installed base, equipment prices, strategic partnerships, ownership, and M&A activities.

For whom? For everybody!

In the past, primarily enterprise-level companies and industry watchers had the resources to invest in CI like this, but Linde Consult makes it available to companies of all shapes & sizes, and to a much wider user-group:

- Executives can use the data to define strategy and roadmap for growth.

- Sales teams are equipped to fight objections and address pain points.

- Marketing teams can adjust their messaging to better reach their user personas.

- Product Development teams can better understand competitors' solutions & models.

Start now!

It has never been easier to start. Once you have access, you can begin taking advantage while the Linde Consult team continues to add OEMs, equipment, and relevant data, ensuring data quality. No need to hire an expensive business analyst or build your own reporting tool. It is all there!

Neem snel contact op!

We horen graag van u via het contactformulier, een e-mail of via telefoonnummer 06 1233 7915.

Neem contact met ons op

Bedankt voor uw bericht.

We nemen zo snel mogelijk contact met u op.

Vriendelijke groet,

Het Linde Consult team

Excuus! Er is een fout opgetreden bij het versturen van uw bericht.

Probeer het later nog eens of neem contact op via info@lindeconsult.nl of de telefoon.

Vriendelijke groet,

Het Linde Consult team